15+ 203k loan vs homestyle loan

Have the repairs and renovations completed. A 15 year fixed loan means youll own your home in half the time of the 30-year loan.

Rehab Calculator

Have the rehabbed home inspected if required.

. A cash-out refinance loan home equity loan or home equity line of credit HELOC allows you to borrow against the current value of your home whereas RenoFi Loans allow you to borrow against the after renovation value or future value of your homeFor homeowners who have been in their homes for 10 years borrowing against current home equity is fine because theyve. 203k rehab loans vs. Get approved for the loan.

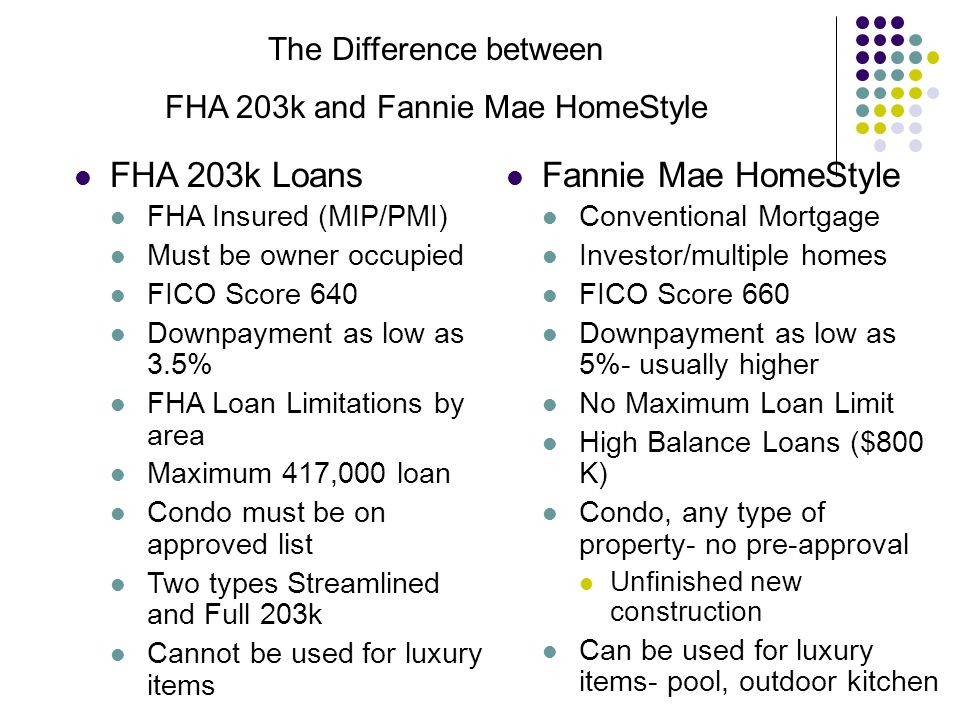

As renovation and home improvement loans become more and more popular in todays housing market Movement offers products such as FHA 203k and Fannie Mae HomeStyle renovation programs to help homebuyers get one loan for both purchase and renovation costs. Request bids from experienced contractors. An FHA 203k loan sometimes called a Rehab Loan or FHA Construction Loan allows you to finance not one but two major items.

An Overview Of First Time Home Buyer Programs. 30 Year Fixed vs. Nations Lending Mortgage Rates For whatever reason Nations Lending does not advertise their mortgage rates on their website or elsewhere as far as I know.

Like the Fannie Mae HomeStyle Renovation loan the FHA 203k loan is a government loan that can simultaneously fund the purchase of a home and renovations under one mortgage loan. On credit cards this will usually be even higher. Close on the loan.

30 Year Fixed vs. This is a good fit for buyers that want to pay more each month in order to shorten the loan and interest period. Freddie Mac tells us that mortgage rates continue their recent ascent with the 30-year rate hitting its highest level since July 2007 with the 15-year rate highest since 2008.

FHA 203K vs Fannie Mae HomeStyle Renovation Oct 19 2018 Learn How To Get A Mortgage Loan With An ITIN. Rehab loans are designed to help homeowners improve their existing home or buy a home. Help you improve or upgrade a home before move-in.

An FHA 203k loan has its pros and cons. In terms of loan programs you can get a fixed-rate mortgage such as a 30-year or 15-year fixed or adjustable-rate mortgage such as a 51 ARM or 71 ARM. There are two.

The FHA 203k loan bases your loan amount on the improved value of the property and requires only 35 down for most applicants Fannie Maes HomeStyle mortgage allows you to finance second. An FHA 203k or Fannie Mae HomeStyle Loan. For the week ending.

Apply for a rehab loan with a participating lender. All different types of loans are. Interest rate means higher monthly payments and its worth noting that these can often be somewhere between 8 and 15.

Other types of rehab loans. A renovation loan program can. Their easy-to-use digital loan application is powered by Ellie Mae.

A personal loan will also typically have far shorter repayment terms than other loan options further increasing your monthly. Including purchase refinance and renovation loans such as the FHA 203k. If your home loan amount exceeds the current conforming loan limit in most cases 647200 a jumbo loan is for you.

So whether youre a first-time home buyer or an existing one they should have a product for you.

Renovation Loans Comparing Fha 203k Vs Fannie Mae Homestyle Renovation Loans For Homebuyers Youtube

Renovation Loans With A Mortgage Fha 203k Conv Va

The Differences Give You Power 203k And Fannie Mae Homestyle Ppt Download

203k Rehab Home Loan Vs Homestyle Home Renovation Loan A Wordpress Site

203 K And Homestyle Loans Buy Renovate With One Mortgage Nerdwallet

Fha 203k Loan Requirements For 2022 Lenders Fha Lenders

203k Rehab Home Loan Vs Homestyle Home Renovation Loan A Wordpress Site

Your Atlanta Renovation Loan Guide Family Mortgage Team

203 K And Homestyle Loans Buy Renovate With One Mortgage Nerdwallet

Homestyle Renovation Vs Fha 203k

Alternatives To The Fha 203k Loan

A Fixer Upper Is In Your Future All About Homestyle And 203 K Construction Loans Philly Home Girls

Homestyle Loan Vs 203k Exploring Which One Would Suit You Us Lending Co

203 K And Homestyle Loans Buy Renovate With One Mortgage Nerdwallet

Buying A Short Sale Home Using An Fha 203k Streamline Or Homestyle Renovation Loan Perry Farella

203k Loan Fees

Mortgage Renovation Options 203k And Homestyle Compared Conclud